7 de marzo de 2023

El senador estatal Jim Brewster ha emitido hoy la siguiente declaración sobre el discurso inaugural del gobernador Shapiro sobre el presupuesto:

El presupuesto del gobernador ofrece un marco sólido para seguir mejorando la educación, la seguridad pública y el medio ambiente. Estoy deseando trabajar con la administración para completar el marco con los detalles que ayudarán a las comunidades a prosperar y a mantener a nuestros vecinos seguros y sanos.

La economía de Pensilvania ha proporcionado ingresos que, a su vez, brindarán la oportunidad de abordar el abandono sistémico y a largo plazo de nuestro sistema de educación pública, un sistema que ha sido declarado inconstitucional por su desigualdad.

Al mismo tiempo, aplaudo al gobernador por esbozar una manera de cambiar la forma en que financiamos la Policía Estatal para crear inversiones sostenibles a largo plazo en la seguridad pública a través de la expansión y mejoras continuas en la formación y equipamiento de nuestros soldados.

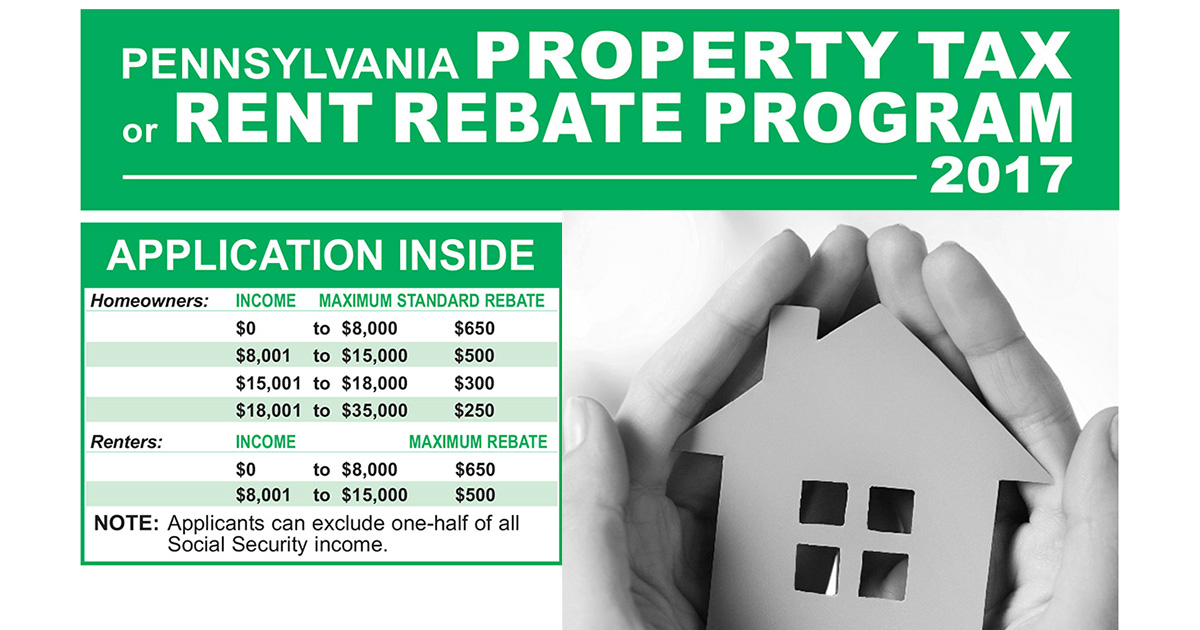

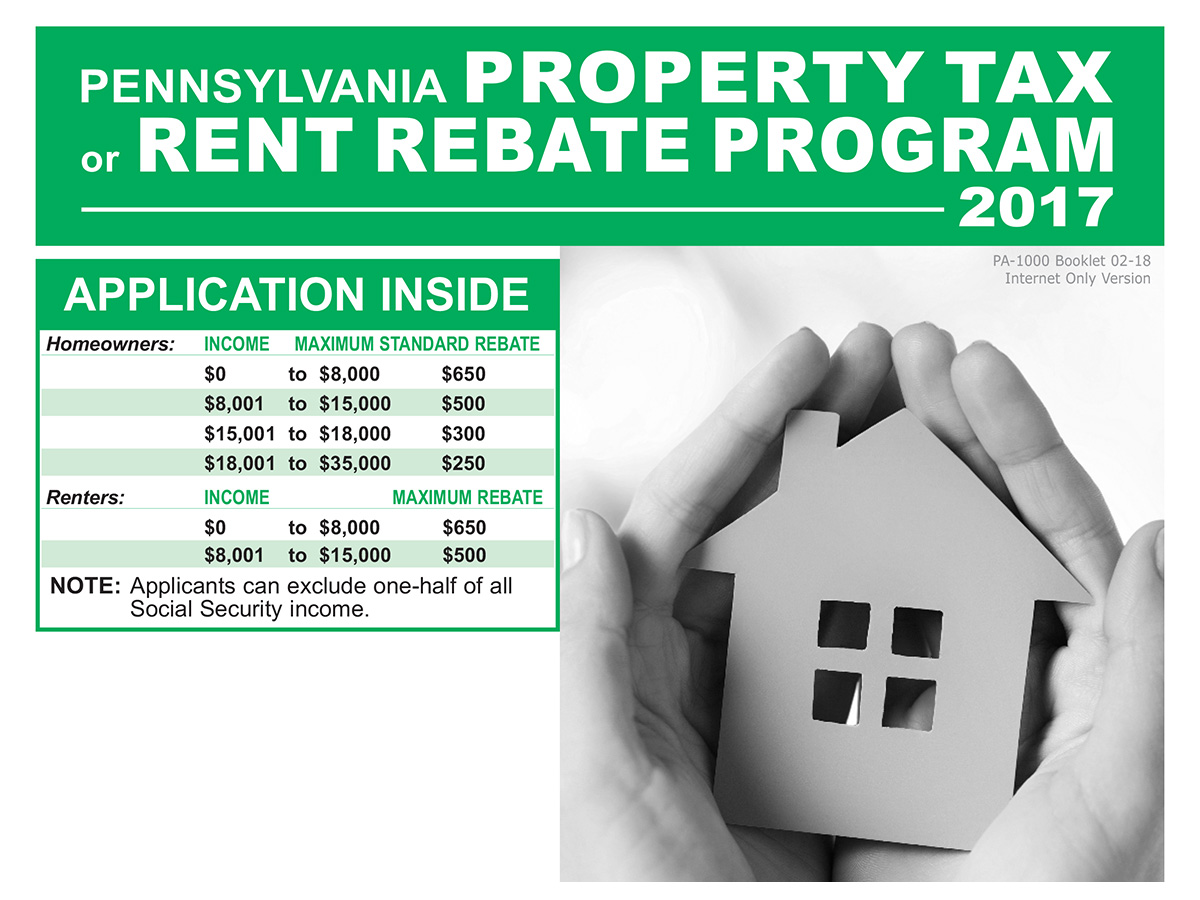

Desde mejoras en el cuidado de los niños hasta la ampliación del Programa de Reembolso del Impuesto sobre Bienes Inmuebles y Alquileres, el presupuesto debería levantar a los habitantes de Pensilvania de todas las edades y en todas las regiones. Es un enfoque reflexivo y equilibrado para gobernar y estoy deseando completar los detalles en los próximos meses. Para más detalles sobre el presupuesto visite pasenate.com/budget.

Junio 14, 2022

Harrisburg, Junio 14, 2022 – The deadline to apply for a property tax or rent rebate has been extended to Diciembre 31st, State Senator Jim Brewster announced today.

El programa está abierto a las personas mayores o residentes con discapacidad que cumplan los requisitos. El plazo anterior para solicitarlo finalizaba el 30 de junio.

"Me complace la decisión del Departamento de Hacienda de ampliar el plazo para solicitar la desgravación del impuesto sobre bienes inmuebles y del alquiler", dijo Brewster. "Este es un programa importante para ayudar a las personas mayores y a las personas con discapacidad a gestionar sus facturas de impuestos sobre la propiedad".

Brewster said by extending the deadline, there will be ample time for qualifying seniors or residents with disabilities to apply and receive financial help.

El senador dijo que sus oficinas están abiertas y que el personal puede ayudar a los electores a presentar solicitudes.

“I encourage eligible seniors who have not yet applied to receive their rebate to please do so as soon as possible,” Brewster said. “This program is a good way to channel funds back to those who need help.”

To be eligible for the Property Tax and Rent Rebate Program, a person must be 65-years of age or older, or, if a widow or widower 50-years of age or older, or be a Pennsylvanian with disabilities earning less than $35,000 per year for homeowners and $15,000 per year for renters. When calculating income, half of social security is excluded. The maximum rebate is $650 for most homeowners.

Para más información sobre el programa o para ponerse en contacto con la oficina de Brewster sobre cualquier otro asunto relacionado con el Estado, los electores pueden llamar al 412-664-5200 o visitar Property Tax/Rent Rebate Program (pa.gov ) para solicitarlo en línea.

Junio 11, 2018

Harrisburg, Junio 11, 2018 – Sen. Jim Brewster (D-Allegheny/Westmoreland) said the property tax and rent rebate program has extended its application deadline to Diciembre 31, 2018.

The program assists seniors and individuals with disabilities reduce their property tax and rent bills. Depending on income, seniors may be eligible for rebates of up to $650.

The program assists seniors and individuals with disabilities reduce their property tax and rent bills. Depending on income, seniors may be eligible for rebates of up to $650.

“The extension will give seniors and individuals who may be eligible to receive assistance through the property tax and rent rebate program more time to apply for help,” Brewster said. “Extending the deadline to the end of the year gives residents the opportunity to gather information and complete applications.”

The original deadline for the program was Junio 30.

Brewster reminds residents who qualify for the program that it is free to apply and his district office is equipped to assist those looking to fill out an application.

“I encourage any individual who thinks they may be eligible for property tax and rent rebates to visit with my staff at any of my district offices or during satellite office hours,” Brewster said. “My staff is very experienced at completing the applications and will be able to answer any question about the program.”

Eligible residents for the program are Pennsylvanians age 65 and older, widows and widowers age 50 and older, and people with disabilities age 18 and older.

Nearly 600,000 seniors and disabled individuals received assistance through the program in 2017.

Since the Property Tax and Rent Rebate Program’s inception through the Department of Revenue in 1971, more than $6.7 billion in property tax and rent relief has been granted to older and disabled adults in Pennsylvania.

-30-

Diciembre 22, 2017

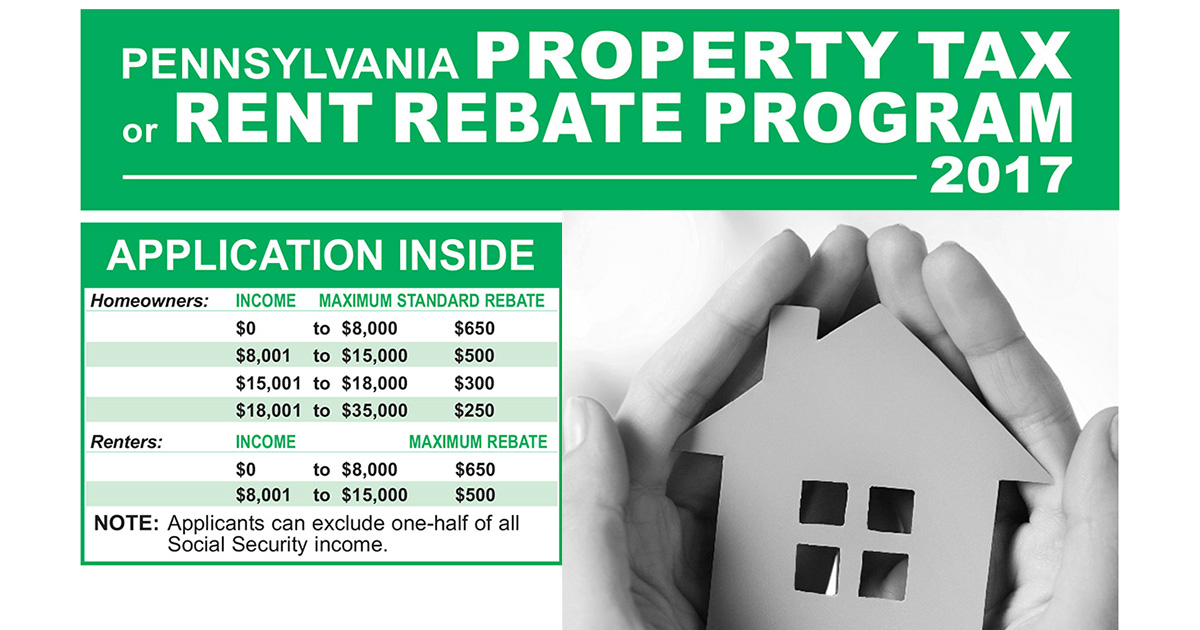

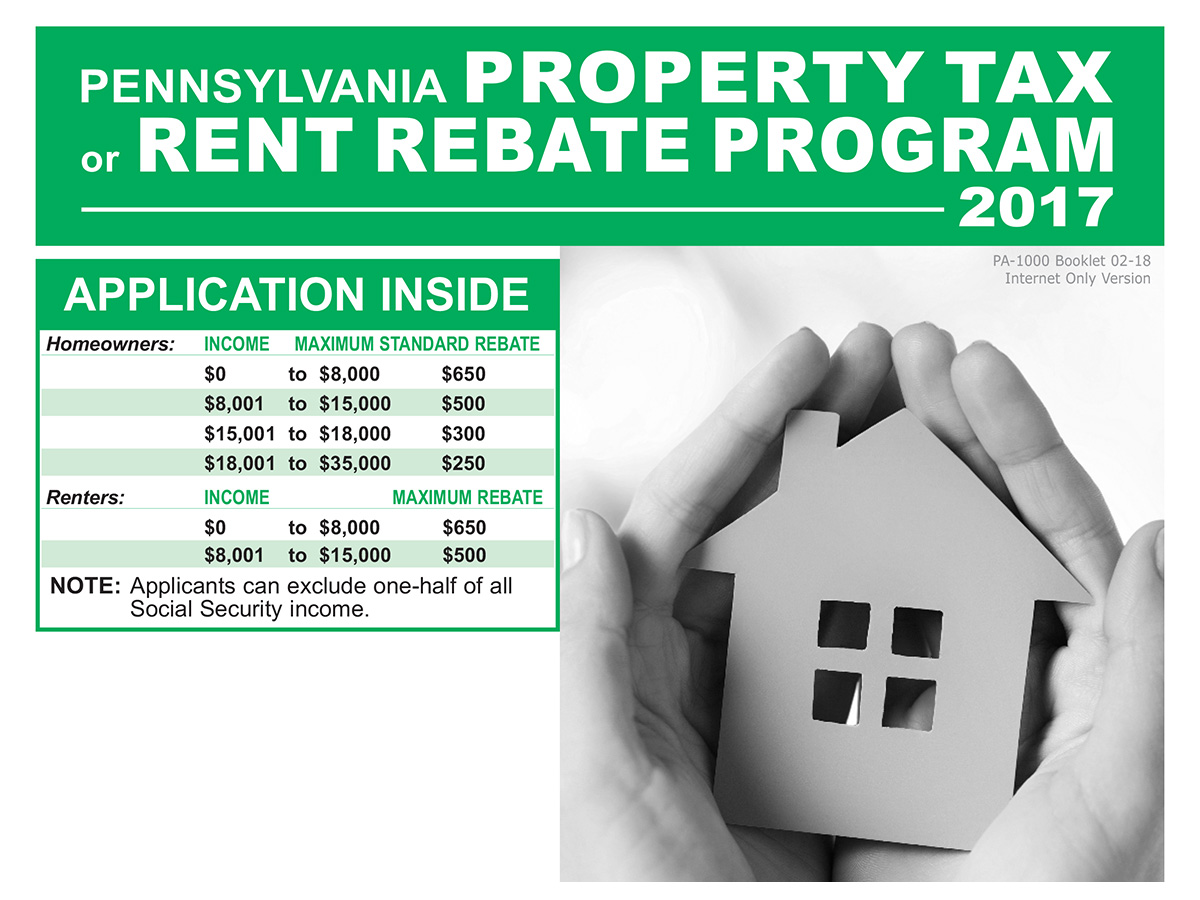

Harrisburg – Diciembre 22, 2017 – Sen. Jim Brewster (D-Allegheny/Westmoreland) is reminding constituents that the deadline to apply for the Department of Revenue’s Property Tax and Rent Rebate program is Enero 2, 2018.

“The property tax and rent rebate program has been an excellent resource in providing relief to those with high property tax and rent bills,” Senator Brewster said. “I want to remind those who are eligible of the program’s Jan. 2 deadline and strongly encourage residents to apply.”

The program is available to Pennsylvanians age 65 and older, widows and widowers age 50 and older, and individuals with disabilities age 18 and older. The maximum standard rebate through the program is $650.

Brewster said his district office staff is available to assist those who need help in completing the application. There is no application fee for the program.

Senator Brewster has district offices located in Monroeville, McKeesport and New Kensington.

“My staff is experienced in assisting seniors and other residents who can benefit from this rebate program,” Senator Brewster said. “They are happy to answer questions and help with the application process.”

Since the program’s inception, $6.1 billion in property tax and rent rebates have been received by approved applicants.

-30-

Febrero 9, 2012

PITTSBURGH, Febrero 9, 2012 – State Senator Jim Brewster today reminded people eligible for the state Property Tax and Rent Rebate Program that he and his local office staff stand ready to assist people for free.

Brewster said some companies are charging seniors up to $50 to help them file for the Lottery-funded property tax/rent rebate program.

“While it’s not illegal to charge people to help them apply for a rebate, I want to remind seniors and others that there is no need to pay for such a service because my office and other state government entities stand ready to provide that help for free,” Brewster said.

The Property Tax and Rent Rebate program benefits Pennsylvanians who are 65 years old and older; widows and widowers age 50 and older; and people with disabilities age 18 and older.

Brewster said he and his local district office staff stand ready to help constituents determine if they are eligible, and assist residents in completing and filing their rebate application. For assistance or to obtain an application, contact any of the Senator’s District Offices:

• One Monroeville Center, 3824 Northern Pike, Suite 350, Monroeville (412) 380-2242;

• 201 Lysle Bvd., McKeesport (412) 664-5200; and

• New Kensington City Hall, 301 11th Street., Suite L (724) 334-1143

Forms can also be found online at www.PaPropertyTaxRelief.com or by calling 1-888-222-9190.

“Again, I hope folks understand that it is not necessary to pay for something that my staff and I will provide for free,” Brewster said.

# # #